Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in DE, CAT, DD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Warren Buffett, one of the most successful investors ever, has said "it's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." In this article, I will discuss three companies which I believe are wonderful companies selling at a fair price. I will also mention three companies which appear to be quality companies selling at cheap valuations that I would avoid.

This stock discussed in this article will meet the following criteria:

1. High quality

2. Cheap or fair valuation relative to historic norms

3. Dividend yield greater than the current 10 year Treasury yield

I have chosen these criteria because I believe that for a company to be considered a "wonderful company at a fair price", it must meet these criteria.

Caterpillar (CAT)

CAT shares have come under pressure of late as investors have reacted to weak results. In particular, CAT's exposure to emerging markets such as China, Brazil, and other Latin American nations has been a cause for concern. However, despite these near term worries, I am confident that, over the long-term, CAT will continue to achieve great things. As shown by the chart below, over the past 10 years, CAT has gained more than 242% while the S&P 500 has gained just 50%. Caterpillar, which traces its roots back to 1925, is the global leader in construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives.

CAT data by YCharts

CAT data by YCharts

In addition to being a high quality company, as shown by the chart below, CAT is also trading at a cheap valuation relative to his historical norm.

CAT PE Ratio TTM data by YCharts

CAT PE Ratio TTM data by YCharts

Finally, as shown by the chart below, CAT currently pays a dividend of 2.5%, which is well above the current 10 year Treasury yield of 1.66%

CAT Dividend Yield data by YCharts

CAT Dividend Yield data by YCharts

Deere & Co (DE)

This year, DE is celebrating its 175th anniversary. Without doubt, DE is one of the oldest companies around. If you are interested, the company's website gives a terrific overview of DE's storied history. DE is the leading provider of machinery to farmers throughout the world. Recently, legendary investor Warren Buffett purchased a stake in DE. This move does not come as a surprise because DE fits so many of the typical Buffett investment qualifications. DE is engaged in a relatively easy-to-understand business, DE has outstanding brand recognition, and DE is trading at a reasonable valuation. Also, DE is exposed to what I believe, like Jim Rogers, will be an agriculture super cycle over the next decades, driven by demand from emerging economies such as India and China. Over the past 10 years, as shown by the chart below, DE has risen more than 230% while the S&P 500 has risen only 50%.

DE data by YCharts

DE data by YCharts

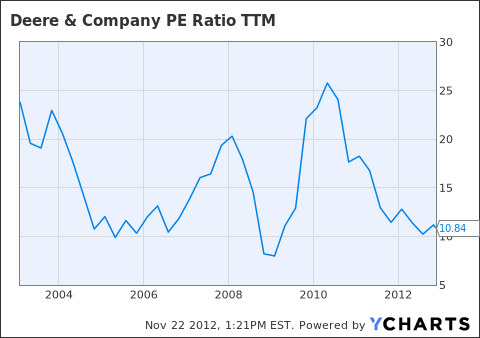

In addition to being a high quality company, as shown by the chart below, DE is also trading at a cheap valuation relative to his historical norm.

DE PE Ratio TTM data by YCharts

DE PE Ratio TTM data by YCharts

Finally, as shown by the chart below, DE currently pays a dividend of 2.1%, which is well above the current 10 year Treasury yield of 1.66%

DE Dividend Yield data by YCharts

DE Dividend Yield data by YCharts

E. I. du Pont de Nemours and Co (DD)

From the company's website:

For more than 200 years, DuPont has brought world-class science and engineering to the global marketplace through innovative products, materials and services. Our market-driven innovation introduces thousands of new products and patent applications every year, serving markets as diverse as agriculture, nutrition, electronics and communications, safety and protection, home and construction, transportation and apparel.

Today, DuPont is proud to build on this heritage by partnering with others to tackle the unprecedented challenges in food, energy and protection now facing our world. With global population expected to approach nine billion by 2050, DuPont is working with customers, governments, NGOs and thought leaders to discover solutions to today's toughest challenges.Together, we believe we can provide enough healthy food for people everywhere, decrease dependence on fossil fuels, and protect people and the environment for generations to come.

We look forward to what a third century of science and innovation can do.

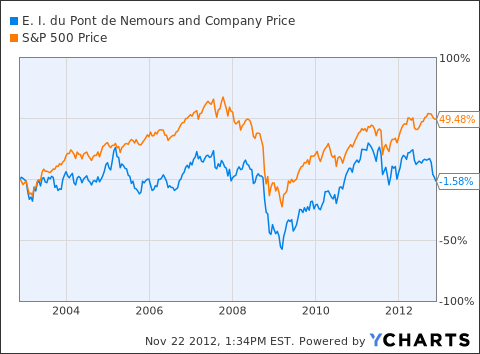

Like CAT & DE, Dupont has as storied a history as any modern company. However, as shown by the chart below, unlike CAT & DE, Dupont has not had a great past 10 years. The weak stock performance over the past 10 years does not change the fact that DD is a high quality company. I view the recent underperformance as a chance to pick up a great long-term growth story.

DD data by YCharts

DD data by YCharts

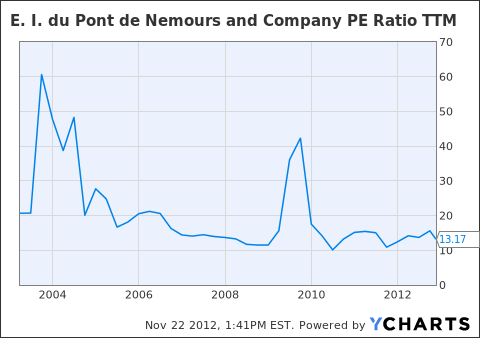

Currently, as shown by the chart below, DD is trading at a cheap valuation relative to its historic norms.

DD PE Ratio TTM data by YCharts

DD PE Ratio TTM data by YCharts

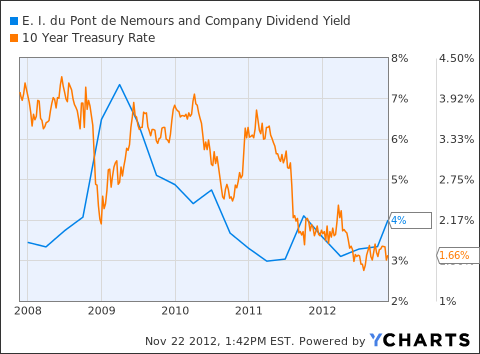

Finally, as shown by the chart below, DD currently pays a dividend of 4%, which is well above the current 10 year Treasury yield of 1.66%

DD Dividend Yield data by YCharts

DD Dividend Yield data by YCharts

Avoid Microsoft, Ford, and Wal-Mart

There are many companies that fit the criteria used in this article including Microsoft (MSFT), Ford (F), and Wal-Mart (WMT). I am not certain about the long-term outlook for these companies as they are all closely tied to the tastes and preferences of consumers, which tend to change with time. While the average age of CAT, DD, and DE is well over 100 years, the average age of MSFT, WMT, and F is just over 65 years. Age is not the only difference between CAT, DE, and DD vs MSFT, WMT, and F. It must be noted that F came very close to bankruptcy during the 2008 recession, proving that it is at best fair quality. MSFT has stagnated over the past decade as other companies such as Oracle (ORCL) and Apple (AAPL) have caused problems for Microsoft. With PC sales on the decline, the future for Microsoft looks mixed, at best. Finally, the global retail leader, WMT will continue to face increased online competition from the likes of Amazon.com for the foreseeable future. Another risk facing WMT over the long-term is a change in consumer behavior. What if, perhaps, the economy proves stronger than most expect and consumers decide to switch from WMT to more expensive, higher quality retailers?

Cyclical vs Secular Headwinds

While CAT, DE, and DD certainly face headwinds, I believe these headwinds are of a cyclical nature, not a secular nature. Throughout history, there have always been ups and downs with the global economy and CAT, DE, and DD seem to always emerge as stronger after each cycle. Comparably, I view the potential headwinds facing MSFT, F, and WMT as secular. Companies facing secular issues have often fallen on difficult times despite the cyclical outlook. Some examples today include Hewlett- Packard (HPQ), Radio Shack Corp (RSH), and Eastman Kodak (EKDKQ.PK). At one time, all of these companies were considered "high quality value plays" however, they all turned out to be value traps as the issues they faced were of a secular nature. Let me be clear, I am not saying that MSFT, F, and WMT will go the way of Kodak, HPQ, or RSH. Rather, I am saying that I cannot endorse MSFT, F, and WMT as buy and hold forever investments.

Conclusion

No, this article does not address the outlook for these companies over the next six weeks, six months, or even six years. For those looking for a shorter-term view, there are many terrific pieces available on Seeking Alpha. Rather, I believe that now is good time to purchase CAT, DD, or DE as a long-term investment. Warren Buffett has often said that his favorite holding period is "forever" and I believe that now is a great time to buy CAT, DD, or DE with the intention of holding forever. Contrastingly, despite fitting my criteria, I cannot endorse MFST, F, or WMT as a buy and hold forever.

4/20 student loan forgiveness ufc 145 weigh ins record store day 2012 detroit red wings jose canseco zimmerman

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.